Therefore, if you make regular deposits into a savings account, monthly home mortgage, monthly insurance account or pension plan, you happen to face an annuity. The first involves a present value annuity calculation using Formula 11.4. Note that the annuity stops one payment short of the end of the loan contract, so you need to use \(N − 1\) rather than \(N\). The second calculation involves a present-value single payment calculation at a fixed rate using Formula 9.3 rearranged for \(PV\). To determine accurately the balance owing on any loan at any point in time, always start with the loan’s starting principal and then deduct the payments made.

Want to get past your fear of financial mathematics and equations?

- Say you want to calculate the PV of an ordinary annuity with an annual payment of $100, an interest rate of five percent, and you are promised the money at the end of three years.

- Let’s presume that you will receive $100 annually for three years, and the interest rate is 5 percent; thus, you have a $100, 3-year, 5% annuity.

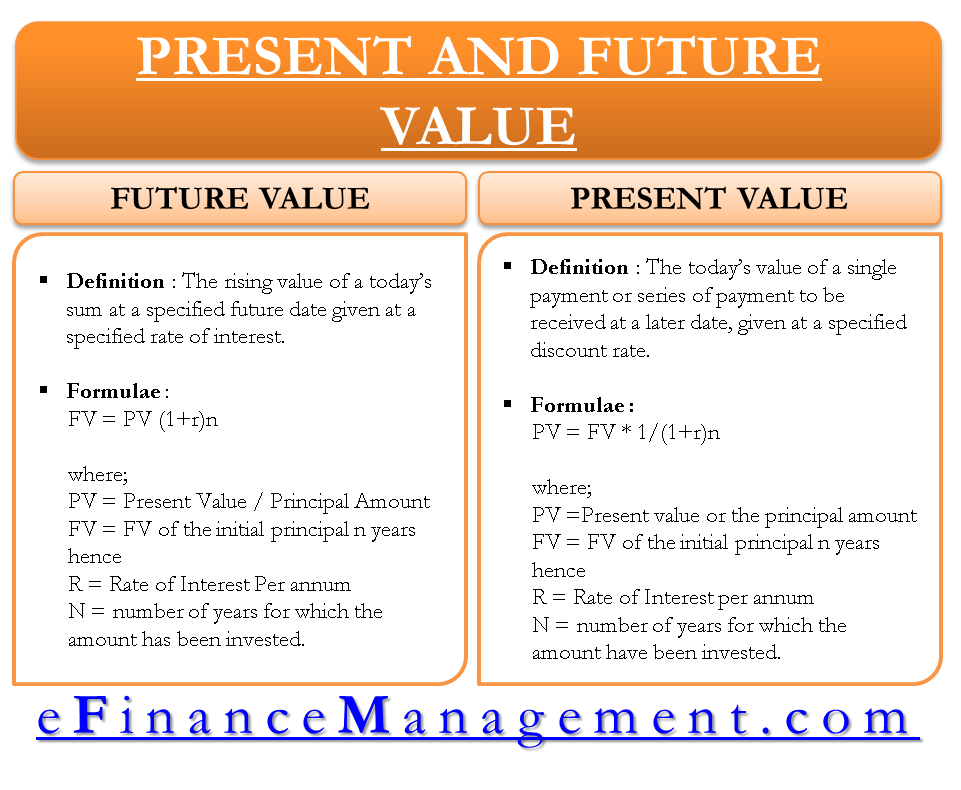

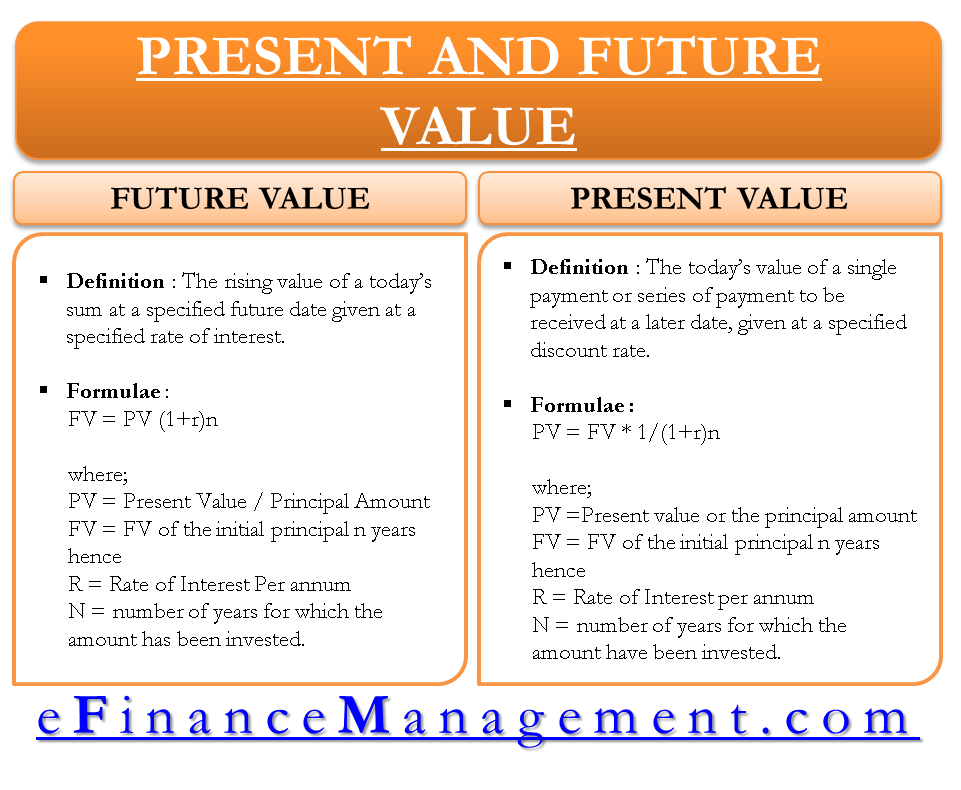

- It is calculated using a formula that takes into account the time value of money and the discount rate, which is an assumed rate of return or interest rate over the same duration as the payments.

- For example, a court settlement might entitle the recipient to $2,000 per month for 30 years, but the receiving party may be uncomfortable getting paid over time and request a cash settlement.

- Because that’s what the Present Value of the future cash flows is equal to.

- Assuming you are the borrower, you enter the present value (\(PV\)) as a positive number since you are receiving the money.

How much money needs to be in the annuity at the start to make this happen? The figure below illustrates the fundamental concept of the time value of money and shows the calculations in moving all of the payments to the focal date at the start of the timeline. The present value of an annuity represents the current worth of all future payments from the annuity, taking into account the annuity’s rate of return or discount rate. To clarify, the present value of an annuity is the amount you’d have to put into an annuity now to get a specific amount of money in the future.

VIEW ALL CALCULATORS

An ordinary annuity is a series of recurring payments that are made at the end of a period, such as payments for quarterly stock dividends. An annuity due, by contrast, is a series of recurring payments that are made at the beginning of a period. In contrast to the FV calculation, PV calculation tells you how much money would be required now to produce a series of payments in the future, again assuming a set interest rate. To calculate the future value of annuity due, make sure the calculator is in BGN mode. To adapt your calculator to an annuity due, you must toggle the payment setting from END to BGN. The payment setting is found on the second shelf above the [latex]PMT[/latex] key (because it is related to the [latex]PMT[/latex]!).

Present Value of Annuity Calculation Example (PV)

You buy an annuity either with a single payment or a series of payments, and you receive a lump-sum payout shortly after purchasing the annuity or a series of payouts over time. Let’s assume you want to sell five years’ worth of payments, or $5,000, and the factoring company applies a 10 percent discount rate. If you own an annuity or receive money from a structured settlement, you may choose to sell future payments to a purchasing company for immediate cash. Getting early access to these funds can help you eliminate debt, make car repairs, or put a down payment on a home. The present value of an annuity refers to how much money would be needed today to fund a series of future annuity payments. Or, put another way, it’s the sum that must be invested now to guarantee a desired payment in the future.

Discover the scientific investment process Todd developed during his hedge fund days that he still uses to manage his own money today. It’s all simplified for you in this turn-key system that takes just 30 minutes per month. If you’re looking for an investment strategy that goes beyond “buy and hold” while controlling risk and requiring as little as 30 minutes a month to manage, this is the answer. Take back control of your portfolio and start getting results today. An independent insurance agent is a great asset to have in your pocket because they know annuities from every direction — after all, they deal with them every single day.

However, this does not account for the time value of money, which says payments are worth less and less the further into the future they exist. That’s why the present value of an annuity formula is a useful tool. For example, if an individual could earn a 5% return by investing in a high-quality corporate bond, they might use a 5% discount rate when calculating the present value of an annuity.

In this case, the bank will want to know what series of monthly payments, when discounted back at the agreed-upon interest rate, is equal to the present value today of the amount of the loan. The value today of a series of equal payments or receipts to be made or received on specified future dates is which legal fees can you deduct on your taxes called the present value of an annuity. This formula considers the impact of both regular contributions and interest earned over time. By using this formula, you can determine the total value your series of regular investments will reach in the future, considering the power of compound interest.

First, we will calculate the present value (PV) of the annuity given the assumptions regarding the bond. So, let’s assume that you invest $1,000 every year for the next five years, at 5% interest. Below is how much you would have at the end of the five-year period.

The value of an annuity at different points in time can present you with different opportunities. While the PMT variable is used in both equations, it represents the payments you receive from an annuity for present value but the payments you make during accumulation for future value. The difference accounts for any interest lost as each periodic payment lowers the account’s principal. So, an immediate annuity that pays $10,000 per year for 10 years should cost about $81,109 with a rate of 4%.