In studying “Analyzing Statements of Cash Flows I” for the CFA, you should aim to understand the components and purpose of cash flow statements, focusing on their role in financial analysis. Learn how cash flows from operating, investing, and financing activities provide insights into a company’s financial health. Explore the impact of non-cash adjustments, such as depreciation and amortization, on operating cash flow, and examine how changes in working capital reflect operational efficiency.

Does not Replace the Income Statement

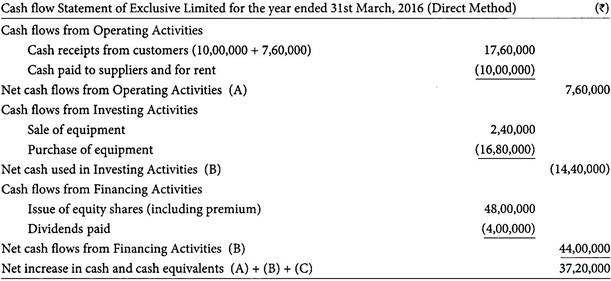

Prepare a statement of cash flows for the current year in proper format using the direct method. Cash flow statements are important as they provide critical information about the cash inflows and outflows of the company. This information is important in making crucial decisions about spending, investments, and credit. Meaning, even though our business earned $60,000 in tax professionals in detroit, michigan October (as reported on our income statement), we only actually received $40,000 in cash from operating activities. In our examples below, we’ll use the indirect method of calculating cash flow. Using the direct method, you keep a record of cash as it enters and leaves your business, then use that information at the end of the month to prepare a statement of cash flow.

The three sections of a cash flow statement

LO 16.6Use the following excerpts from SwanseaCompany’s financial information to prepare the operating section ofthe statement of cash flows (direct method) for the year 2018. LO 16.6Use the following excerpts from FromeraCompany’s financial information to prepare the operating section ofthe statement of cash flows (direct method) for the year 2018. LO 16.3Use the following excerpts from NutmegCompany’s financial records to determine net cash flows fromoperating activities and net cash flows from investingactivities. LO 16.3Use the following excerpts from GrenadaCompany’s financial records to determine net cash flows fromoperating activities and net cash flows from investingactivities. However, if you haven’t paid the interest, it appears as a current liability on your balance sheet.

What are the implications of positive and negative cash flows?

LO 16.3Use the following information fromChocolate Company’s financial statements to determine operating netcash flows (indirect method). LO 16.3Use the following information fromAlbuquerque Company’s financial statements to determine operatingnet cash flows (indirect method). Understanding cash flow statements can help you manage your business’s finances by revealing not just the amounts but also the sources and uses of cash. To help visualize each section of the cash flow statement, here’s a cash flow statement example of a fictional company generated using the indirect method.

Great! The Financial Professional Will Get Back To You Soon.

That’s money we’ve charged clients—but we haven’t actually been paid yet. Even though the money we’ve charged is an asset, it isn’t cold hard cash. For most small businesses, Operating Activities will include most of your cash flow. That’s because operating activities are what you do to get revenue.

- And it, lastly, it gives us a little more information between the relationship of net income and cash flow.

- LO 16.6Use the following excerpts from AlgonaCompany’s financial statements to determine cash received fromcustomers in 2018.

- For example, payment of supplies is an operating activity because it relates to the company operations and is expected to be used in the current period.

- We’re going to be dealing with our investments in long-term assets as well as in long-term investments.

- Like the fund flow statement, this statement also shows the inflow and outflow of cash between two time periods—generally from January to 31 December.

Our Team Will Connect You With a Vetted, Trusted Professional

It’s not just about whether the company is profitable on paper but whether it has enough liquidity to meet obligations and grab growth opportunities when they arise. Cash flow statements are powerful financial reports, so long as they’re used in tandem with income statements and balance sheets. Keep in mind, with both those methods, your cash flow statement is only accurate so long as the rest of your bookkeeping is accurate too. The most surefire way to know how much working capital you have is to hire a bookkeeper.

Next, you need your net income figure (available on the income statement) and opening cash balance (available on your balance sheet). Finally, you need to understand the format of a cash flow statement prepared using the indirect method. It also reconciles beginning and ending cash and cash equivalents account balances. The cash flows from operating activities section provides information on the cash flows from the company’s operations (buying and selling of goods, providing services, etc.).

11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. The most important part of a Cash Flow statement is net incom, because it shows how much money a company earned during a given period. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. He is the sole author of all the materials on AccountingCoach.com.